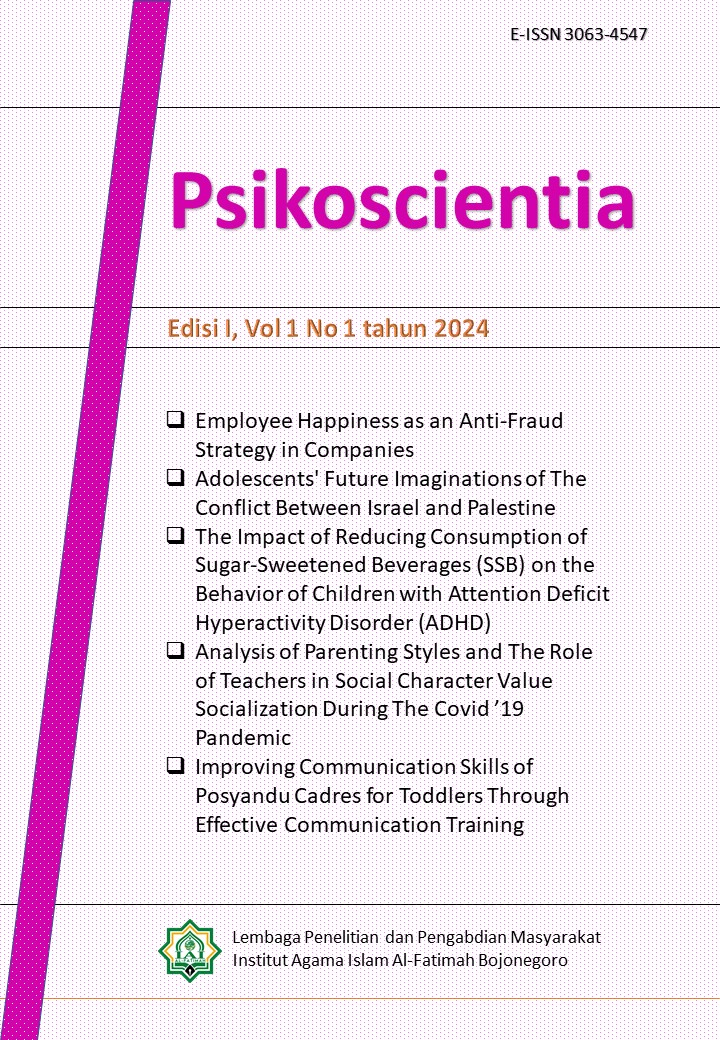

Employee Happiness as an Anti-Fraud Strategy in Companies

Keywords:

Employee Happiness, Anti-Fraud Strategy, Case Study, FraudAbstract

This study aims to explore employee happiness as an anti-fraud strategy for companies. This study is qualitative research based on a case study through a literature study, observation, and interviews at a retail company in Indonesia. The results show that employee happiness is a concern of the company through activities oriented towards employee welfare, including family day, employee focus, appreciation of long service awards, competition activities in the context of Indonesian independence, slaughtering sacrificial animals, sports activities, visiting sick employees, and other activities related to employees. Company leaders are able to be role models for their employees in implementing and appreciating employee performance in daily life in the office, thus having an impact on growing employee loyalty in the company. Employee loyalty makes employees happy, and this is an effective strategy for preventing potential employee fraud in the company. This research contributes to practitioners in implementing employee happiness as an effective prevention of employee fraud in companies and to academics as literacy related to employee happiness as an anti-fraud strategy. The limitations of this study are in the generalization aspect because it focuses on only one retail company in Indonesia

References

ACFE. (2017). Fraud Examiners Manual 2017 International Edition. In Association of Certified Fraud Examiners (ACFE). Association of Certified Fraud Examiners, Inc.

Agustien, E., & Soeling, D. (2020). Pengaruh Organizational Commitment, Happiness at Work, dan Motivasi Kerja terhadap Kinerja Pegawai di BKKBN. Jurnal Ilmu Administrasi Publik, 8(2), 285–302.

Azubike, O., & Bruce, L. (2013). Employees’ attitude towards fraudulent behaviors. Employees’ Attitude towards Fraudulent Behaviors, 3(12), 16–38.

Balogun, S. K., Selemogwe, M., & Akinfala, F. (2013). Fraud and Extravagant Life Styles Among Bank Employees: Case of Convicted Bank Workers in Nigeria. Psychological Thought, 6(2), 252–263. https://doi.org/10.5964/psyct.v6i2.68

Barylska, I. S. (2013). Whistleblowing as a Symptom of Employee Loyalty - Polish Perspective. International Journal of Business and Social Science, 4(15), 49–57.

Beaulieu, P., & Reinstein, A. (2020). Connecting organizational culture to fraud: Buffer/ conduit theory. Advances in Accounting Behavioral Research, 23, 21–45. https://doi.org/10.1108/S1475-148820200000023002

Bestari, D., & Prasetyo, A. R. (2019). Hubungan Antara Happiness At Work Dengan Organizational Citizenship Behavior Pada Karyawan Pt. Telkom Witel Semarang. Jurnal EMPATI, 8(1), 33–39. https://doi.org/10.14710/empati.2019.23571

Byington, J. R., & McGee, J. A. (2012). Are Your Cash Transactions Protected? The Journal of Corporate Accounting & Finance, 11–15. https://doi.org/10.1002/jcaf

Cressey, D. R. (1950). The Criminal Violation of Financial Trust. American Sociological Review, 15(6), 738–743. http://www.jstor.org/stable/2086606

Dewi, I. O., Wahyudi, I., Setiawan, N., & Uyun, J. (2023). Fraud Ditinjau dari Etika Profesi dan Etika Bisnis Kasus PT Garuda Indonesia. Media Komunikasi Ilmu Ekonomi, 40(1), 41–53. https://doi.org/https://doi.org/10.58906/melati.v40i1.101

Fadhila, D. A., & Achmad, T. (2023). Peran Moralitas Aparatur dan Sistem Pelaporan Pelanggaran dalam Mencegah Kecurangan Dana Desa. Jurnal Akademi Akuntansi, 6(4), 524–537. https://doi.org/10.22219/jaa.v6i4.29352

Hermawan, S., & Amirullah. (2016). Metode Penelitian Bisnis: Pendekatan Kuantitatif & kualitatif. Metode Penelitian Bisnis Bandung, 264.

Khan, A. J., Bhatti, M. A., Hussain, A., Ahmad, R., & Iqbal, J. (2021). Employee Job Satisfaction in Higher Educational Institutes: A Review of Theories. Journal of South Asian Studies, 9(3), 257–266. https://doi.org/10.33687/jsas.009.03.3940

Koomson, T. A. A., Owusu, G. M. Y., Bekoe, R. A., & Oquaye, M. (2020). Determinants of asset misappropriation at the workplace: the moderating role of perceived strength of internal controls. Journal of Financial Crime, 27(4), 1191–1211. https://doi.org/10.1108/JFC-04-2020-0067

Maslow, A. H. (1943). A Theory of Human Motivation. Psychological Review, 50, 370–396. https://doi.org/10.4324/9781315258324-16

Maulidiyah, D. N. (2023). Consensus on the role of culture in restraining financial crime: a systematic literature review. Journal of Financial Crime. https://doi.org/10.1108/JFC-05-2023-0103

Nawawi, A., & Salin, A. S. A. P. (2018). Internal Control and Employees’ Occupational Fraud on Expenditure Claims. Journal of Financial Crime.

Nigrini, M. J. (2019). The Patterns of The Numbers Used in Occupational Fraud Schemes. Managerial Auditing Journal, 34(5), 602–622. https://doi.org/10.1108/MAJ-11-2017-1717

Pangow, R. J. (2021). Analisa Pengukuran Kinerja Menggunakan Balance Scorecard Pada PT Hasjrat Abadi Sudirman Manado. Institut Teknologi Sepuluh Nopember.

Petterchak, J. W. (2022). An inch of progress: new ethics opinion gets real about assistance to fraud and crime. Journal of Financial Crime, 29(2), 721–728. https://doi.org/10.1108/JFC-04-2021-0091

Raj, B., Kolachina, S., Kumar, B. R., & Kusum. (2018). Assessment of Risk Factors in Misappropriation of Assets - Evidence from the Indian Banking Sector. International Journal of Pure and Applied Mathematics, 118(24), 1–13.

Setiawan, N. (2023a). Pendayagunaan Filantropi Islam dan Warning Signals Terhadap Potensi Fraud. Iqtishoduna Jurnal Ekonomi Dan Bisnis Islam, 19(2), 158–172. https://doi.org/http://dx.doi.org/10.18860/iq.v19i2.20780

Setiawan, N. (2023b). Urgensi Pengelolaan Keuangan Masjid dalam Meningkatkan Akuntabilitas dan Pencegahan terhadap Fraud. Tawazun: Jurnal Ekonomi Syariah, 3(1), 21–32.

Setiawan, N. (2024a). Accountability for Mosque Financial Management: How Important Is It? Islamic Micro Finance Journal, 1(1), 49–66.

Setiawan, N. (2024b). Donor Due Diligence, Education, Donor Statements, and Financial Report Transparency as A Prevention of Money Laundering in Islamic Philanthropy. Istinbath: Jurnal Hukum Dan Ekonomi Islam, 23(1), 49–65.

Setiawan, N. (2024c). Religiosity for preventing employee fraud. Journal of Applied Managerial Accounting, 8(1), 1–14. https://doi.org/doi.org/10.30871/jama.v8i1.7080

Setiawan, N., & Alim, M. N. (2022). Islamic Philanthropy as a Deterrent to Potential Fraud. Share: Jurnal Ekonomi Dan Keuangan Islam, 11(1), 129. https://doi.org/10.22373/share.v11i1.11074

Setiawan, N., & Cholili, A. (2023). Cultural Values as Anti-Fraud Strategy: Lessons from Islamic Schools. SHARE Jurnal Ekonomi Dan Keuangan Islam, 12(2), 500–525. https://doi.org/10.22373/share.v12i2.20120

Setiawan, N., & Soewarno, N. (2024a). Protection of Hajj and Umrah Pilgrims from Fraud: Evidence from Indonesia. Share: Jurnal Ekonomi Dan Keuangan Islam, 13(1), 908–930. https://doi.org/http://dx.doi.org/10.22373/share.v13i1.22865

Setiawan, N., & Soewarno, N. (2024b). Zakat Disbursement Efficiency for Accountability and Prevention of Zakat Misappropriation. International Conference on Islamic Economic, 77–100. https://doi.org/https://doi.org/10.58223/icie.v3i1.307 Introduction

Setiawan, N., Tarjo, T., & Haryadi, B. (2022). Asset Misappropriation Employee Fraud: A Case Study on an Automotive Company in Indonesia. Jurnal Ilmiah Akuntansi Dan Bisnis, 17(2), 214. https://doi.org/10.24843/jiab.2022.v17.i02.p03

Setiawan, N., & Wahyudi, I. (2023). Pencegahan fraud pada kejahatan siber perbankan. Kabilah: Journal of Social Community, 8(14), 508–518.

Subhan, Ustman, & Fahorrahman. (2022). Does Tax Morale Able to Moderate the Relationship Between Perceptions of Corruption and Taxpayer Compliance. Jurnal Akademi Akuntansi, 6(3), 385–399. https://doi.org/10.22219/jaa.v6i3.22895

Sugiyono. (2020). Metode Penelitian Kualitatif. Alfabeta.

Suh, J. B., Shim, H. S., & Button, M. (2018). Exploring The Impact of Organizational Investment on Occupational Fraud: Mediating Effects of Ethical Culture and Monitoring Control. International Journal of Law, Crime and Justice, 53(February), 46–55. https://doi.org/10.1016/j.ijlcj.2018.02.003